Success Story

Visa

NovoPayment partnered with Visa to create a set of solutions that accelerated the adoption of emerging technologies for real-time payments and secure digital commerce.

The Challenge

Visa needed to create a variety of API-enabled account payable ‘set-plays’ to be used by partner banks in facilitating various instant payment and mass payout services.

Our Approach

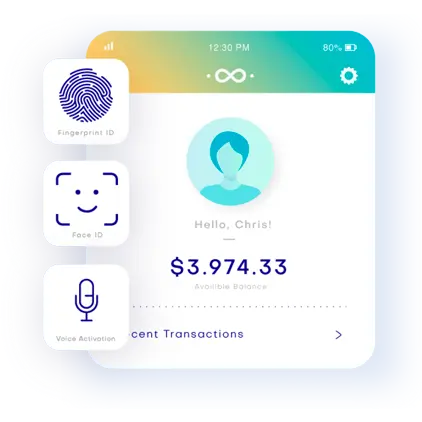

NovoPayment and Visa combined their APIs to provide the interoperability, compliance, business rules, and API orchestration required to deliver secure and self-serving financial services for various use cases, as well as account-card solutions.

Success

The API-enabled ‘set-plays’ allowed corporate clients to automate virtual and card-based account origination, fund loading and reloading, fund recovery, redeployment, and account blocking. Reload volumes doubled every four months, providing increased deposit volumes and transaction revenue, and enhanced customer experience for Visa banking clients.