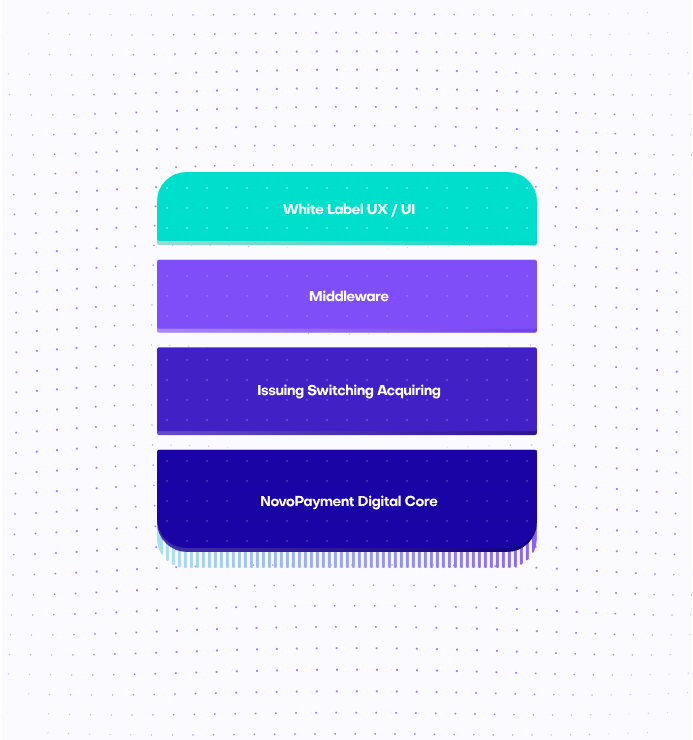

Modular solutions to modernize your banking operations

Discover the broad benefits of our digital core, account origination, online banking, and modular services.

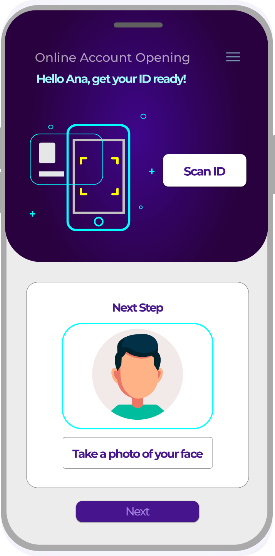

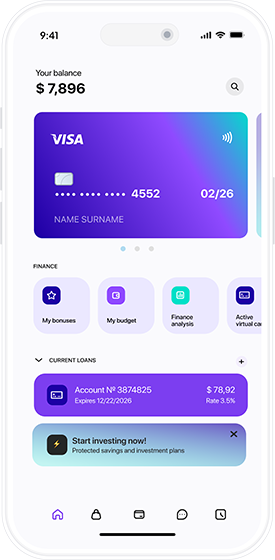

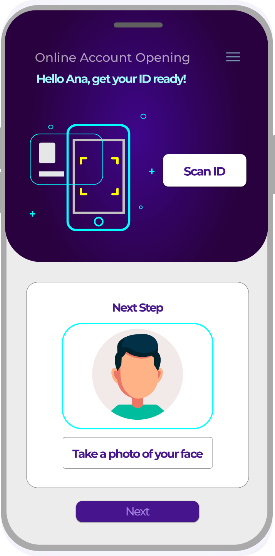

It’s no secret that people expect to be able to interact with their bank digitally, quickly, and easily. From opening new accounts to simply checking balances, a seamless, intuitive digital banking experience is no longer a ‘nice to have’ – it’s imperative in order for banks to survive and cultivate lasting relationships with their customers.

We help banks, financial institutions, merchants, fintechs, neobanks, and other brands to create new revenue streams and cultivate lasting customer relationships.

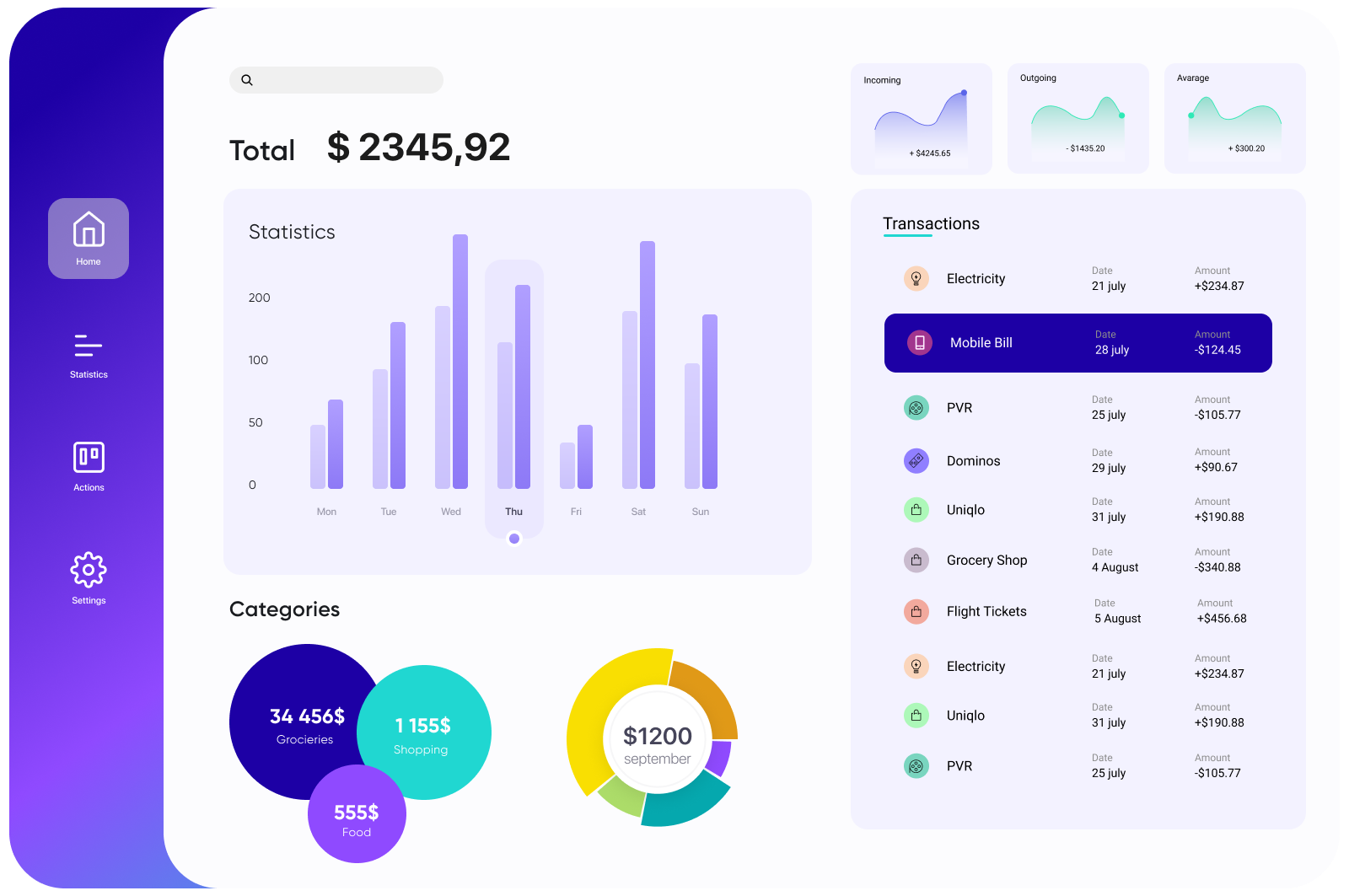

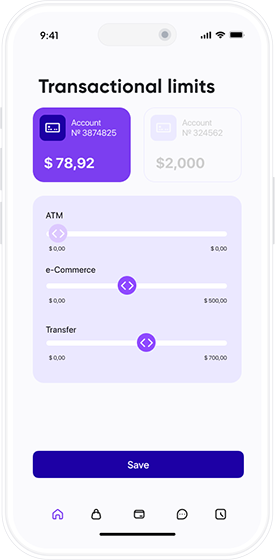

Give customers access to your services from anywhere, anytime

Quickly launch a new niche bank to target specific customer segments

Reach unbanked and underbanked customers with digital-only solutions

Embed banking services into your product offering

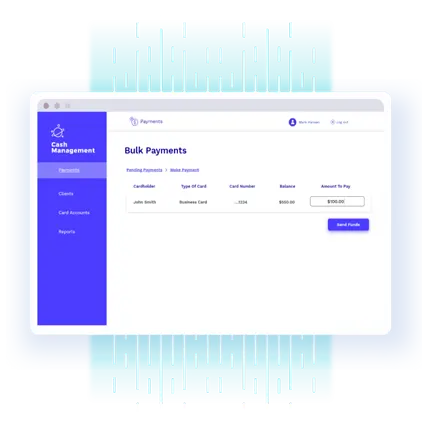

Control cash flow and oversee employee expenses

Capture payments through embedded options with today’s purchasers in mind.

Leverage modern payment methods for consumer, corporate, and government programs

Learn how NovoPayment can complement your core technology to enable next-level customer experiences.