Branded cards that breathe new life into your customer journey

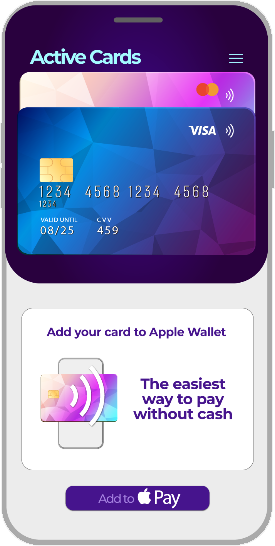

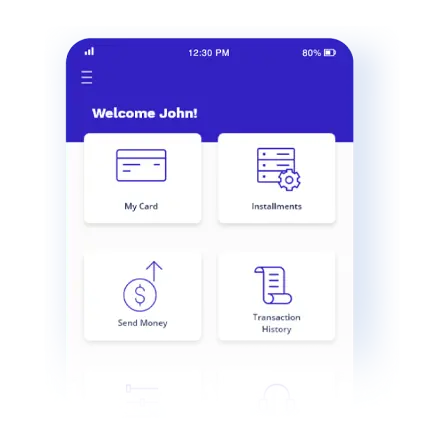

Instantly issue virtual and physical cards, tailored to your customers’ needs.

We help banks, financial institutions, merchants, fintechs, and other brands to create new revenue streams and cultivate lasting customer relationships.

Simplify the shopping experience and extend your brand

Drive financial inclusion for unbanked and underbanked customers

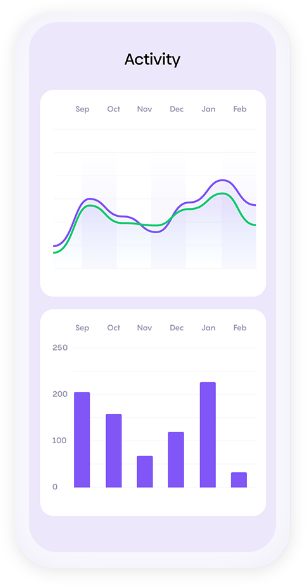

Control cash flow and oversee employee expenses

Lend and pay differently by replacing cash and checks with cards

Instantly issue virtual and physical cards, tailored to your customers’ needs.

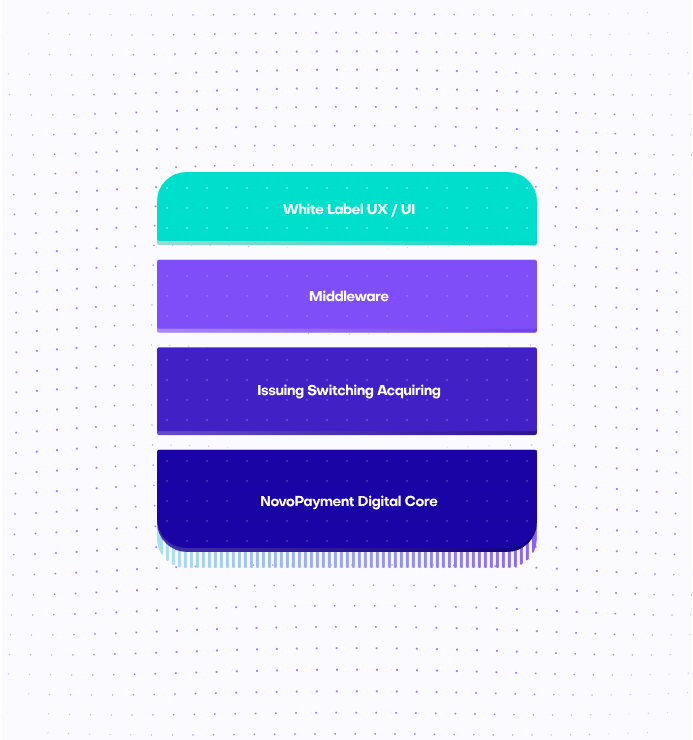

Learn how NovoPayment can complement your core technology to enable next-level customer experiences.