How Banks Can Meet Customers’ Rising Demands for Digital Services

As digital experiences have become the norm in everything we do – from shopping to entertainment and even medical appointments – consumers around the world have come to expect complete, easy-to-use digital tools and programs that can be accessed quickly and at the click of a button. And banking and financial services are no exception to these evolving expectations.

Not only are banking and financial services not an exception to these rising demands for digital, but they have begun to lead the charge in many ways. A study by Forrester Consulting [1] commissioned by NovoPayment revealed that 86% of digital transformation decision-makers at community banks and credit unions reported an increase in customer demand for digital services.

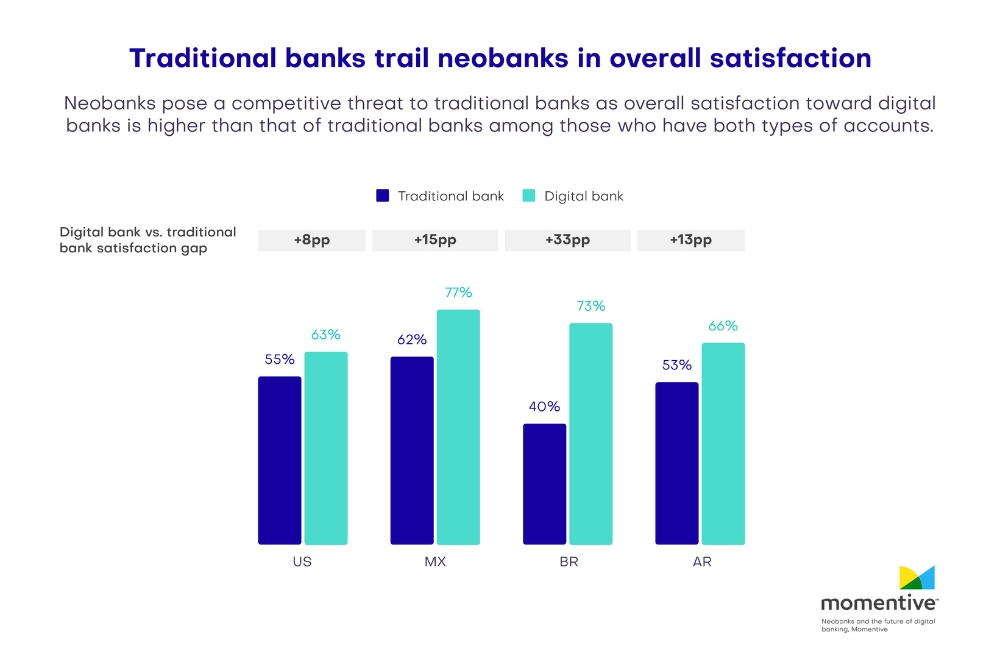

In addition to expecting and demanding digital services from their financial services providers, consumers have also reported higher satisfaction with digital banks over traditional banks. One study revealed that 63% of customers are very satisfied with their digital bank in the U.S., compared to 55% of those who use traditional banks. [2]

The same study revealed an even greater satisfaction gap between digital and traditional banks in Latin America. In Mexico, satisfaction toward digital banks is 15 percentage points higher than that of traditional banks (77% vs 62%), and Argentina sees a similar disparity (66% vs. 53%). Satisfaction with traditional banks is lowest in Brazil, with satisfaction toward digital banks close to twice as high as traditional banks (73% vs 40%).

Faced with evolving consumer preferences and competition without geographical limitations, banks are facing a ‘life or death’ scenario in which they need to offer customers seamless, easy-to-use digital experiences, or risk losing them to competitors that were quicker to modernize their offerings to meet the demand.

The urgent need to offer integrated digital experiences their customers seek has been clear to banks for quite some time now. A 2015 study by CGI titled “Financial Consumer Demands for Tomorrow’s Digital Bank” found that 90% of consumers preferred online banking services, regardless of their age, income, place of residence or type of bank. [3]

Eight years later, and the level of urgency for banks to offer the digital services customers seek is exponentially greater as our world has become increasingly digital. The same Forrester study found that 80% of the surveyed bank decision-makers were worried that their customers will move to banks with more available digital services.

Making it happen with legacy infrastructure and providers, however, is easier said than done. These legacy technological infrastructures and inflexible core systems continue to be a common hindrance for many banks, limiting the products they can develop internally and the pace in which they can do so.

The specific organizational, technological and process-related challenges reported by bank leaders that are hindering their digital initiatives range from day-to-day tactical activities taking up too much time to the growing complexity of the IT environment, lack of collaboration between teams, and lack of alignment on a cohesive digital initiative strategy. [1]

In turn, many banks have come to realize that there’s a more efficient way to adapt to the rapidly increasing digital demand – and it’s all about partnerships with digital-savvy providers.

The Partnership Model

As the extent of what’s required to meet consumers’ digital expectations have become clear, leaders at banks have come to realize that while in-house tech is important, partnering with the new, digital-savvy BaaS providers that provide the technology for neobanks and Fintechs is often more beneficial than competing against them.

As such, 88% of bank leaders surveyed by Forrester equally rated in-house digital technologies and external partners as “Important” and “Very important” to their digital initiatives, with partnerships with “as-a-service” companies to complement their organization’s core competencies right behind at 87%. [1]

These FIs are determining their internal strengths and then selecting the external partnerships that work for them to best fill their gaps – an apt approach that should be taken by banks of all sizes.

While BaaS partnerships have traditionally meant banks embedding their own products and services in third-party platforms and ecosystems via BaaS providers, banks are increasingly finding benefits in consuming the same modular capabilities from BaaS. This approach allows banking providers, from large incumbents to smaller banks and credit unions, to offer products and services (that are delivered by a BaaS provider via APIs) with more speed and dynamism than ever before, with the time it takes to develop and launch new products often reduced from months to days or weeks. By quickly launching new, intuitive financial products that customers want, banks become better positioned to both attract new customers – especially when competitors are lagging – and retain their existing customer base.

In summary, partnering with BaaS providers allows banks and FIs to fill gaps that might exist in their digital capabilities and adapt to the ever-changing financial landscape more quickly and effectively by implementing compelling digital initiatives that customers seek. As a result of BaaS partnerships, “decision-makers expect better CX, faster deployments, and an improved IT environment that allows for even more flexibility and better adaptation to change.” [1]

Whether a financial institution decides to modernize and/or build their digital offerings primarily in-house or through partnerships, what’s clearer than ever before is that in today’s rapidly evolving financial services environment, those who stall face a serious risk of falling behind their competitors. Banking-as-a-Service has emerged as a viable path for many organizations in recent years, and the trend is only continuing to grow.

[1] The 2023 Nimble Bank Playbook: Strategic Partnerships And The Technologies Banks Are Looking To Adopt, NovoPayment, Forrester

[2] Neobanks and the future of digital banking, Momentive

[3] Financial Consumer Demands for Tomorrow’s Digital Bank, CGI